On this page

NatWest mortgages are available to over 18s. Your home or property may be repossessed if you do not keep up repayments on your mortgage.

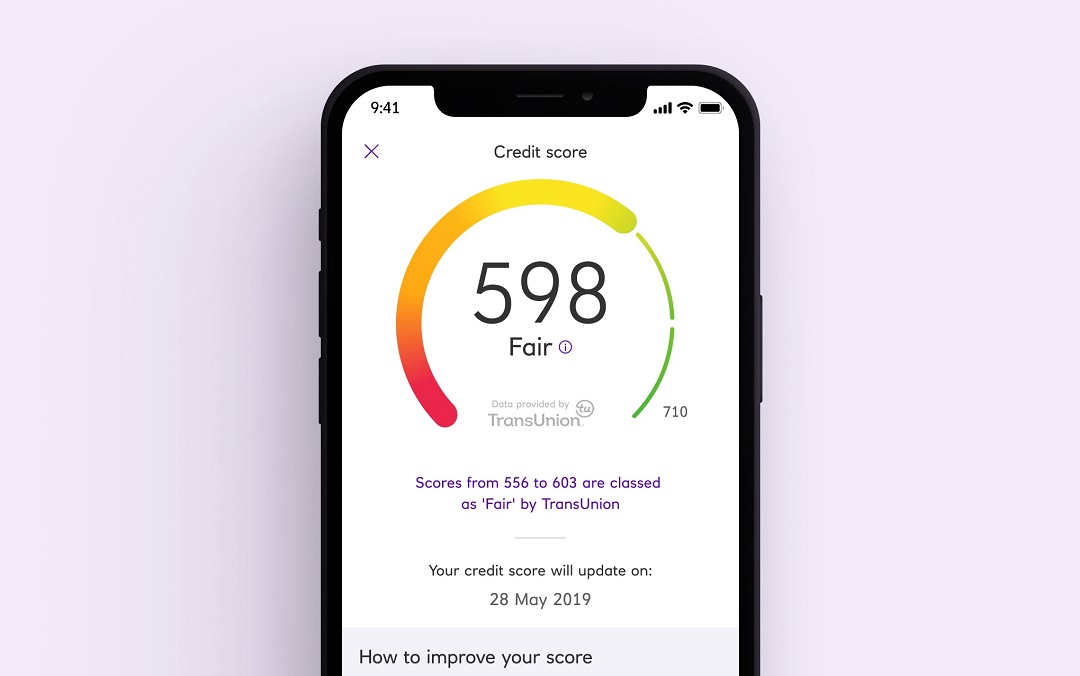

1. Check your credit report

You can view your credit score on our app or if you don’t have the NatWest app you can use various platforms such as Experian, Equifax or ClearScore.

There are ways to help improve your credit score (such as registering on the Electoral Roll at your main address) which you may want to try and tackle if you already know what your credit score is.

Credit score available once opted in through the app, to customers aged 18+, with a UK address and is provided by TransUnion. App available to customers aged 11+ with a compatible iOS and Android device and a UK or international mobile number in specific countries.

4. Evidence of where your deposit is coming from

This is important as lenders will need to see Proof of Deposit to understand where your deposit is coming from.

- If your deposit is from your savings, you’ll need to provide evidence via bank statements and any large payments will need to be explained. The bank statements will also need to show your name and address.

- Gifted mortgage deposits will usually require a signed letter from the person who is gifting you the money. At NatWest, we require a signed letter or email (no signature required) from the gifting party, confirming the gift is either non repayable or repayable.

What if I'm self-employed or a freelancer?

If you’re self-employed, you’ll need to provide the following additional documents required for proof of income:

Proof of income (2 years)

- Certified accounts

- SA302 form and tax year overview from HMRC

- Business bank statements

Looking to buy to let?

If you're looking for a property to let out, the mortgage process is very similar to the residential mortgage process but there are some differences regarding eligibility and criteria.

Find out more about how to buy to let or learn more about buy to let mortgage criteria.

Now you know what you'll need, why not start an Agreement in Principle?

It takes less than 10 minutes, plus you can save and continue from where you left off

It provides you with a personalised indication of what we could lend

Useful to show your estate agent that you're a serious buyer and gives you more confidence in the price of properties you can afford

Does not impact your credit score

You're not committing to get a mortgage with us but, if you do want one, then you'll need an Agreement in Principle first

Our Paperless Mortgage application

When you're ready to apply for a mortgage, you can now upload, view and sign all your documents online.

Find out more about paperless mortgage applications