On this page

What is Housemate?

Our bill splitting app, Housemate, is here to help with problems that might crop up when sharing household expenses.

You don't have to bank with us to use Housemate. As long as you have an eligible UK bank account, Housemate can help make payments easier using Open Banking and even help you plan for the future by recognising your rent payments to build your history with our partner Experian.

Housemate is a free app open to users aged 17+ across the UK. Users must have a UK bank account and an iOS or Android compatible device. Open Banking is available for selected UK banks and account types only. You need to be registered for your own bank’s online banking. The rent recognition feature is only open to those residing in England or Wales.

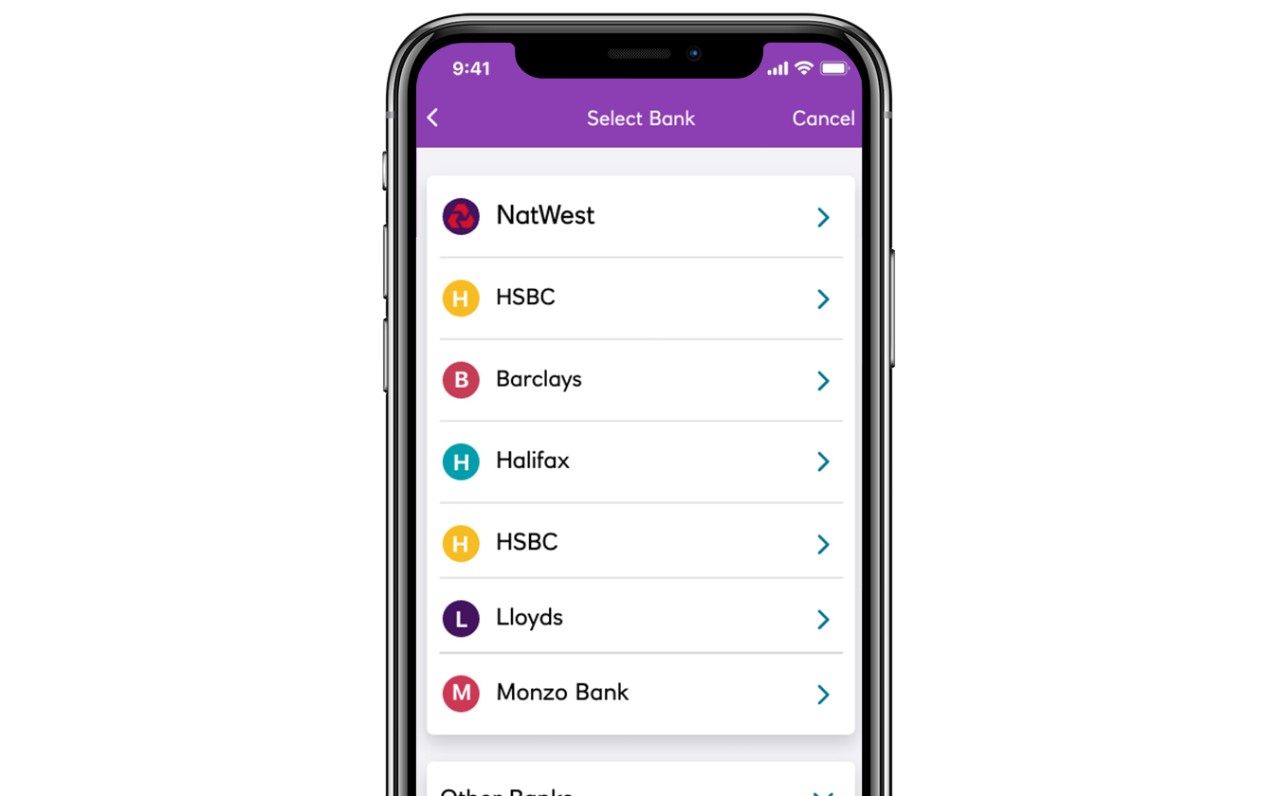

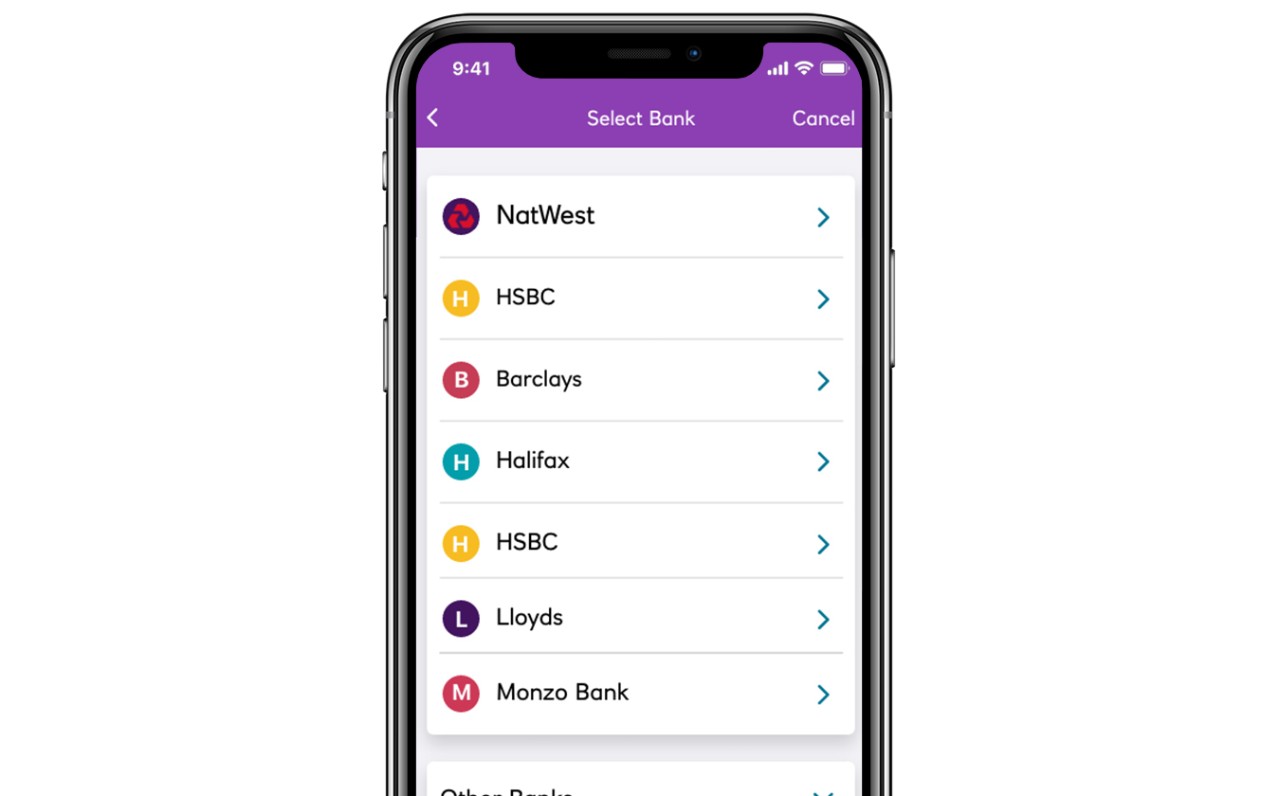

Link your bank

We use Open Banking to ensure that you and your housemates get the full Housemate functionality, regardless of who you bank with, so long as they’re Open Banking enabled; most banks are. Whether it’s in-app payments to each other or syncing your latest transactions, everyone is an equal in our house.

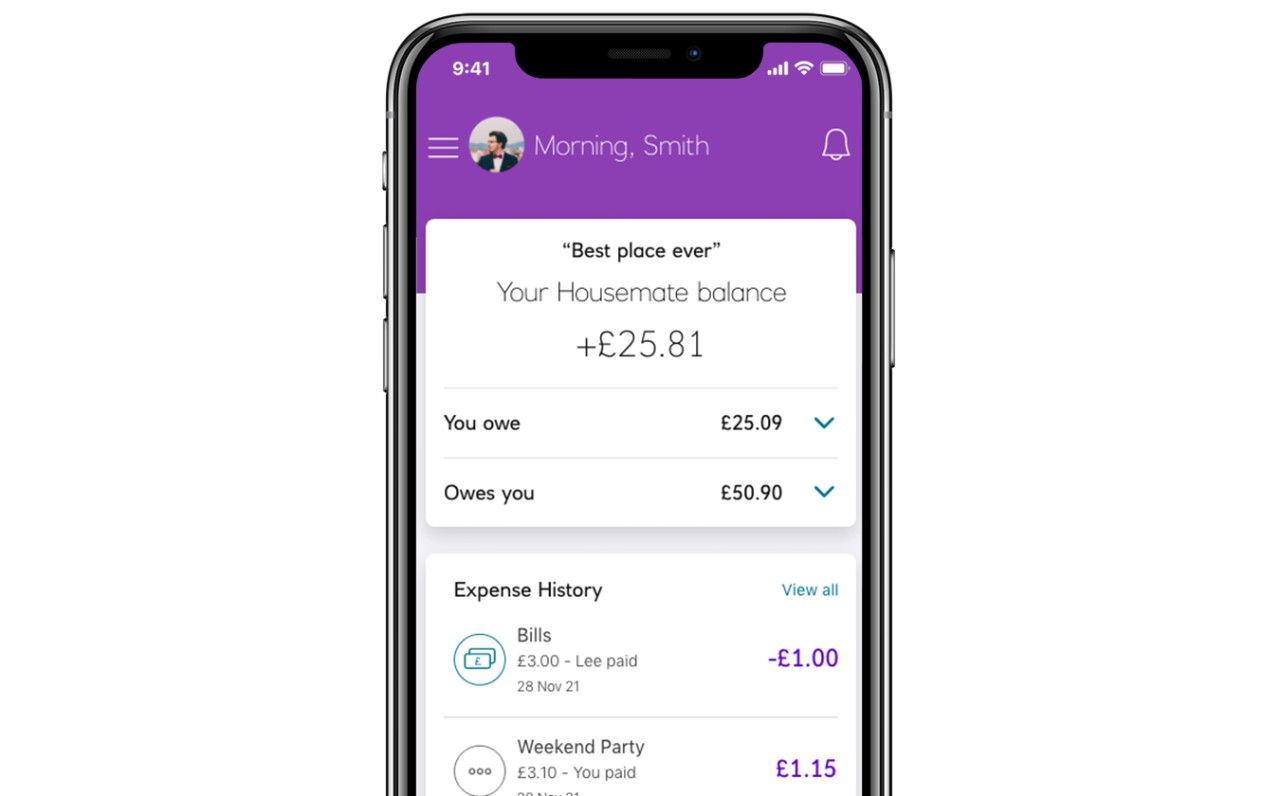

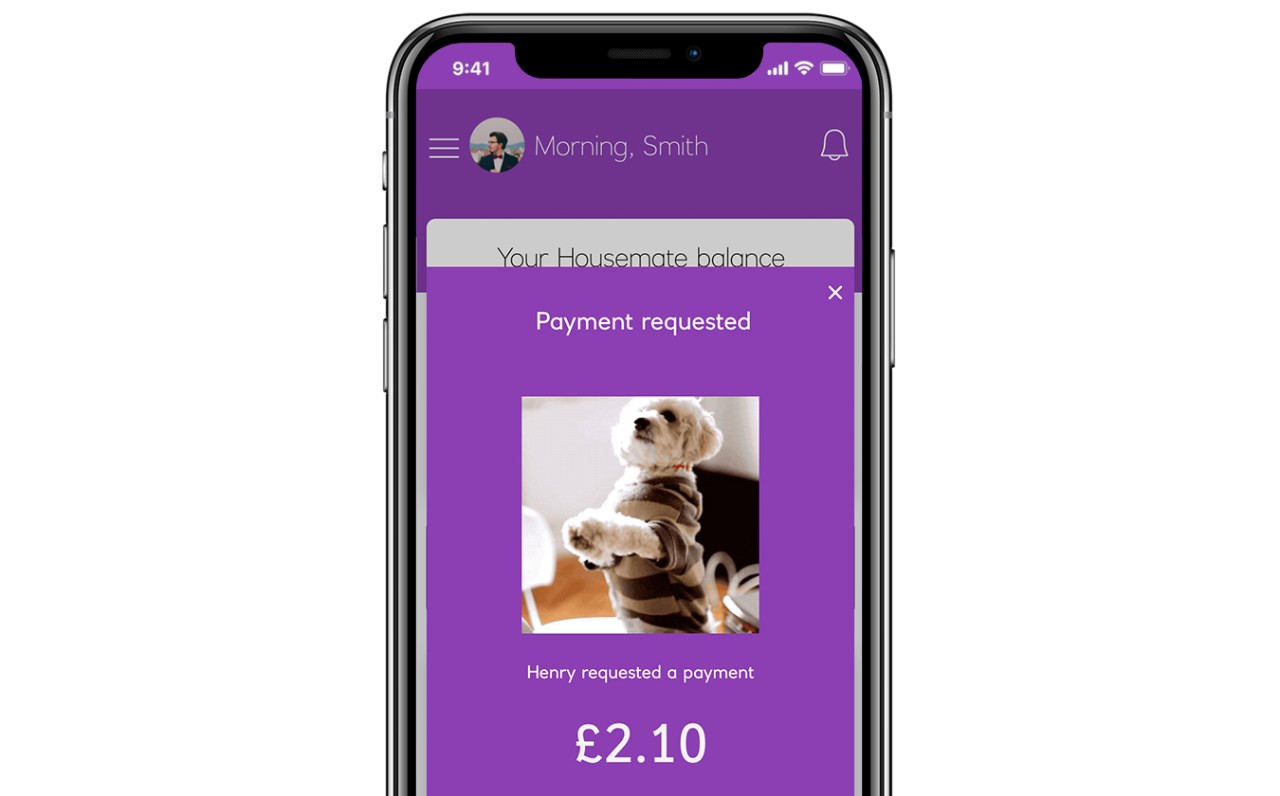

Settle up seamlessly

Housemate balance helps you stay on top of ‘who owes who’ with one complete list of transactions – especially useful if you’re on a tight budget. An easy way to settle up rent, bills or household costs with the entire house, or to pay just one person you live with.

Have a clear record with housemates

Our app keeps things clear and simple. You can add expenses straight from your bank account, see your transaction history and if anyone you live with needs an *ahem* gentle cue to pay up – our GIF reminders will save you from nagging.

Build for the future

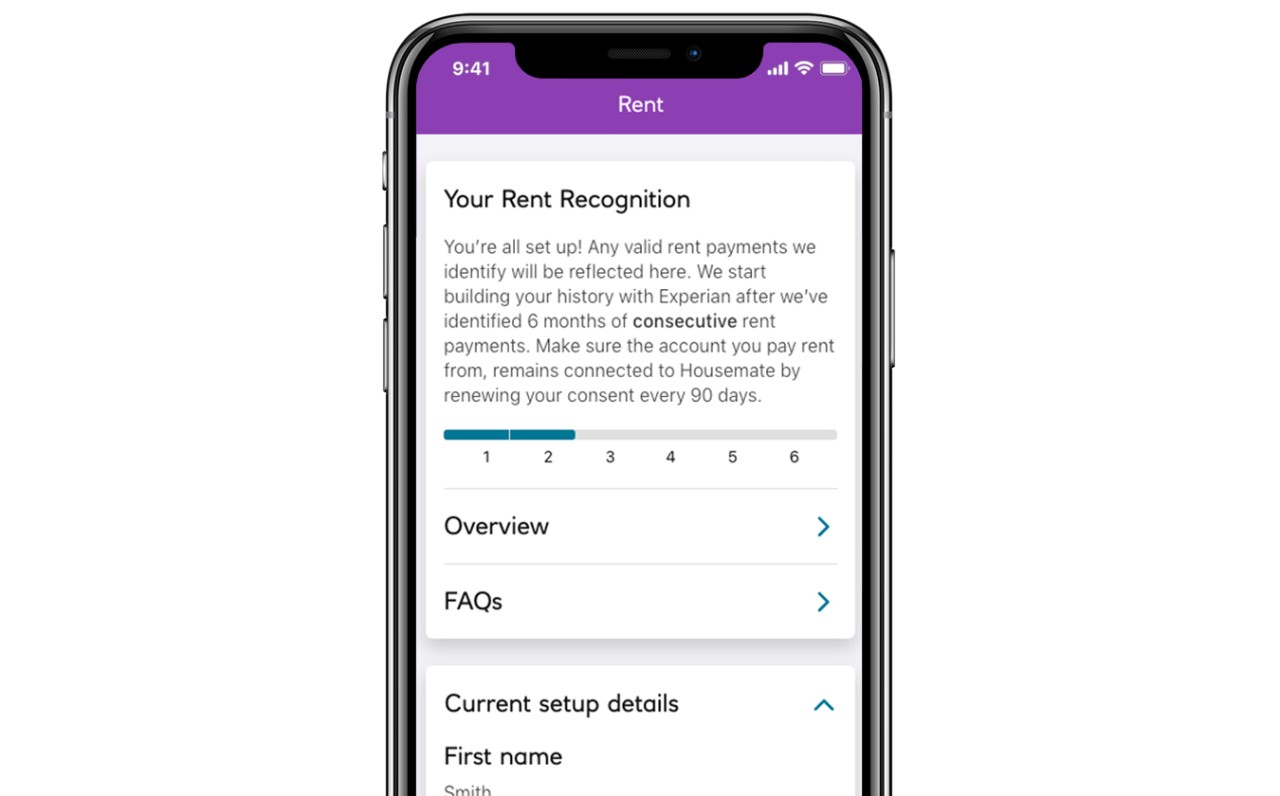

You can build up your history with our partner Experian when you register your rent payments with Housemate (this feature is currently only available in England and Wales). This will not directly improve your credit score but it can help lenders identify you if you apply for credit. We’ve got a ‘Credit score checklist’ on the app that contains key actions that you can take to improve your score.

For the one who likes to keep on top of things

Open Banking lets you connect most UK bank accounts to our new app.

For the one who needs to write everything down

Whether you’re a part of a shared household, a student house share or a roommate, keep on top of things with automated reminders and easily split bills.

For the one who usually sorts out ‘who’s paying what’

Make splitting shared household bills and rent a piece of cake and avoid any disagreements with housemates.

For the one who plans for the future

Get recognition for your rent payments and build your history with our partner Experian.

What is it?

Your credit history contains all the information held on how you’ve managed credit in the past. Your credit score is a numerical representation of your credit file and predicts the likelihood that you’ll pay your credit on time in the future.

Why does it matter?

The more comprehensive your credit history and in turn score, the more likely you are to be accepted for a wide range of financial products such as loans, mortgages, credit cards and other common household bills including phone and energy contracts.

How could Housemate help?

Using Housemate will not directly improve your credit score but it can help build your history with our partner Experian. Our rent recognition feature allows you to share your rent payments with Experian (currently only available in England & Wales). The more data you have in your credit file, the more likely it is that lenders will be able to identify you if you apply for credit.

Check Your Credit Score for Free with NatWest

Checking your credit score and using our personalised tips to improve it, could help you kick start a brighter financial future. The higher your score, the more likely you are to get better deals and interest rates on mortgages, loans and credit cards.

Free for those aged 18 or over with a UK, Channel Islands, or Isle of Man address, following successful registration. Data provided by TransUnion.

Important documents to read

Housemate privacy notice

Housemate terms & conditions

Student living

Did you know rent is the biggest expense facing students in the UK? Luckily, we have tips to help you sort your budget.

Key renting considerations

It’s always good to know what’s ahead of you. Learn more about renting, from costs and fees to knowing your rights.

Becoming a homeowner

It’s a big step but we have everything you need to know. From saving for a deposit to stamp duty to the mortgage application process.